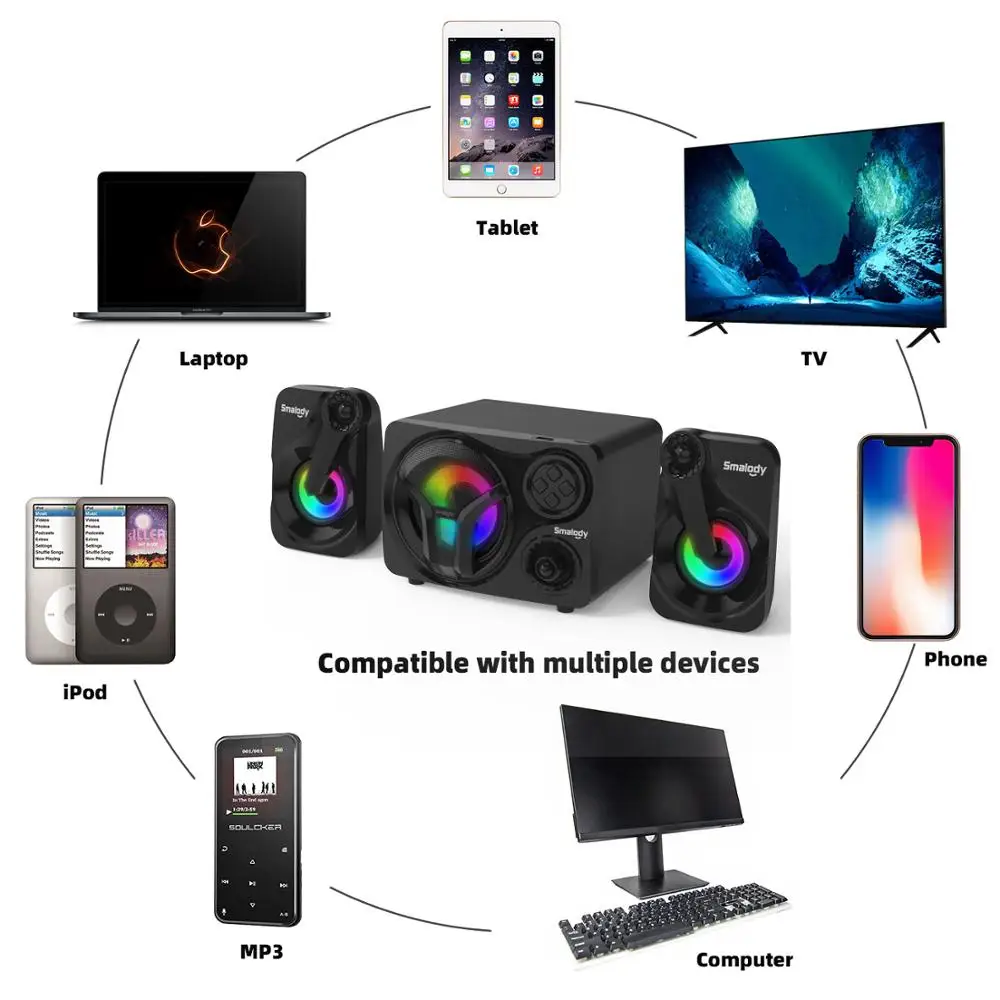

Kupiti Laptop laptop/računalo / PC zvučnik i subwoofer, USB Soundbar Sound Bar Stick music player zvučnici za tablet / Prodaja \ www.countryclub.com.hr

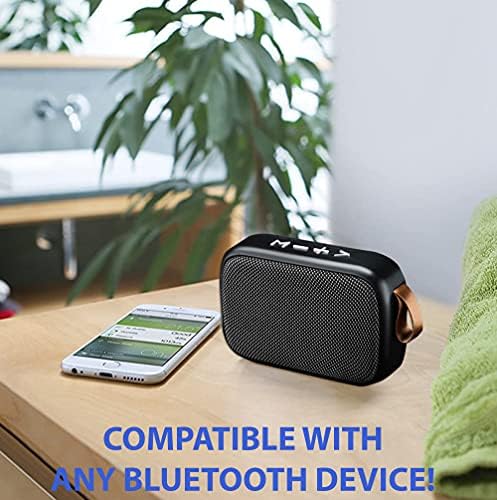

Rasprodaja Bežični zvučnik bluetooth računalni tv računalo laptop usb zvučnik glazbena kolumna zvučnici subwooferi s remenom za nošenje fm - novi / Printmarket.com.hr

Yuxi 9 Modela Topla Rasprodaja Ovalne, Okrugle Tablet Računalo Zvučnici Prijenosni Audio Oprema Dodatna Oprema Rezervni Dijelovi Za Popravak Prijenosni Zvučnik kupiti | Rezervni Dijelovi Za Mobilne Telefone \ www.strojevi.com.hr

Računalna Zvučna Ploča Zvučnici USB Žičnih Stereo PC Zvučnici Stereo 3D Zvuk Mala Zvučna Ploča Za Desktop Laptop Tablet Večernji kupiti | Prijenosni Audio i video > Tabgha.com.hr

Rasprodaja Prijenosni zvučnik bluetooth bežična stupac kućno kino drveni zvuk stereo glazba subwoofer aux 3,5 mm računalni zvučnici s mikrofonom - novi / Printmarket.com.hr

Yuxi 9 Modela Topla Rasprodaja Ovalne, Okrugle Tablet Računalo Zvučnici Prijenosni Audio Oprema Dodatna Oprema Rezervni Dijelovi Za Popravak Prijenosni Zvučnik kupiti | Rezervni Dijelovi Za Mobilne Telefone \ www.strojevi.com.hr

Zvučnik Za Stolne Stolove, Prijenosni Zvučnici, Zvučnici, Zvučnici, Zvučnici, Zvučnici, Zvučnici, Zvučnici, Ova Kategorija Zvučnici

Styz Vašim Sony Xperia Z2 Fabric Design 3w Igru Putovanja Ova Kategorija. Prijenosni Bluetooth Zvučnici. Www.jodiedaviesthompson.com

Yuxi 9 Modela Topla Rasprodaja Ovalne, Okrugle Tablet Računalo Zvučnici Prijenosni Audio Oprema Dodatna Oprema Rezervni Dijelovi Za Popravak Prijenosni Zvučnik kupiti | Rezervni Dijelovi Za Mobilne Telefone \ www.strojevi.com.hr

Bežični Zvučnik Bluetooth, Prijenosni Audio Panel, Bluetooth, 2 Kanala, 10 W, Zvučna Ploča, Zvučnik, Pogodan Za Kino, Tablet Tv, Pc, Telefon, Rasprodaja - Prijenosni audio i video > Eldan.com.hr

Kupiti Laptop laptop/računalo / PC zvučnik i subwoofer, USB Soundbar Sound Bar Stick music player zvučnici za tablet / Prodaja \ www.countryclub.com.hr